Taipei, Oct. 16 (CNA) Taiwan has more semiconductor capacity than any other economy in the world, and that strength could prompt China to take it over amid growing tensions between Beijing and Washington, according to U.S.-based market information advisory firm IC Insights.

In a research paper, IC Insights said Taiwan commanded a 21.4 percent of global installed IC capacity, ahead of South Korea's 20.4 percent, Japan's 15.8 percent and China's 15.3 percent, North America's 12.6 percent, and Europe's 5.7 percent.

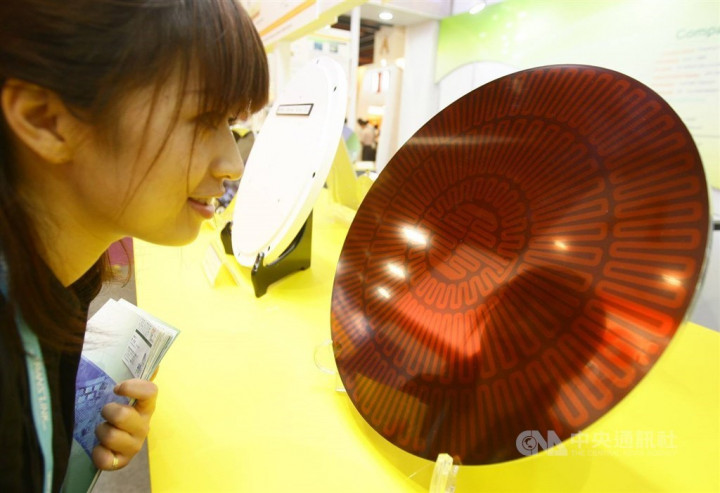

In addition, Taiwan held a 62.8 percent share of the world's capacity for producing advanced ICs using the 10 nanometer process or better, ahead of South Korea, which holds the remaining 37.2 percent.

China, on the other hand, continues to face difficulties in developing its semiconductor sector, made worse by American sanctions on some of its high-tech companies, leading Beijing to question how it will compete in the industry, IC Insights said.

That question is especially relevant because future growth will be increasingly dependent on the continued introduction of advanced electronic systems, the key components of which are ICs, according to the advisory firm, which believes Taiwan is part of the answer.

"It is increasingly apparent that China's answer to that question centers on its reunification with Taiwan," IC Insights argued.

"The bottom line is that, currently, there is no more important base of IC capacity and production than Taiwan," it said.

If China were to attempt to take over Taiwan militarily, both sides would see their economies suffer, it said, though it suggested that a cross-Taiwan Strait conflict might only have a short-term impact.

"The question is whether China is willing to accept relatively short-term economic pain for the long-term benefit of having the largest amount of the world's leading edge IC production capacity under its control for many years to come," IC Insights said.

Taiwan's IC strength stems largely from contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), which boasts the largest share of cutting edge technologies, while South Korea depends on Samsung Electronics Co., according to IC Insights.

TSMC and smaller Taiwanese contract chipmakers such as United Microelectronics Corp., Powerchip Technology Corp. and Vanguard International Semiconductor Corp., are expected to make up almost 80 percent of the global pure-play foundry market in 2021, the report said.

Though that could be appealing to Beijing, many observers have described TSMC and Taiwan's semiconductor sector as a "silicon shield," a term first coined in a book by Craig Addison in 2001 called Silicon Shield: Taiwan's Protection against Chinese Attack.

TSMC Chairman Mark Liu recently echoed the view in an earnings call in mid-July.

"As to [an] invasion [by] China, let me tell you ... everybody wants to have a peaceful Taiwan Strait ... because it is to every country's benefit, [and] also because of the semiconductor supply chain in Taiwan -- no one wants to disrupt it," he said.